VAT-Checker

Check VAT-Status and read our guide about the VAT checking procedure and details you should know about.

Use VIES-on-the-Web To Protect Your Business

If you’re a business owner or a trader operating within the European Union (EU), ensuring that your transactions comply with EU VAT regulations is crucial. One way to do this is by verifying the validity of a VAT number before entering into any transaction. A VAT number is a unique identification number assigned to each registered business within the EU for VAT purposes. It’s important to ensure that the VAT number is valid and belongs to the entity it claims belongs to avoid potential issues with tax authorities.

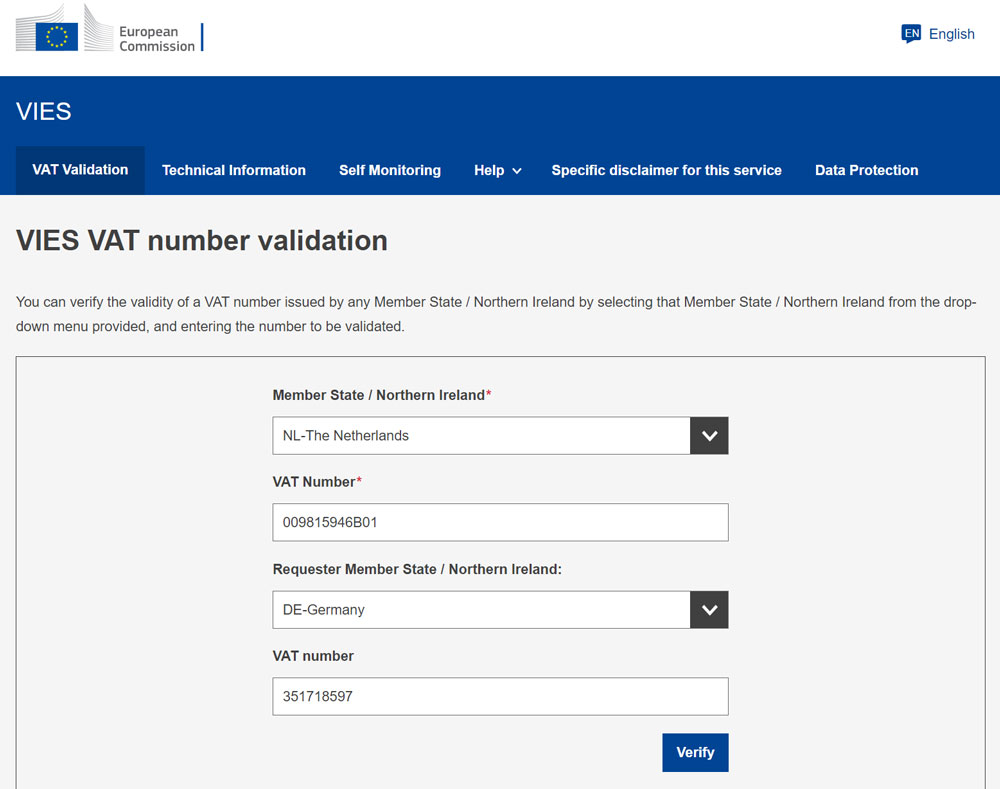

Fortunately, checking the validity of a VAT number is a straightforward process. The European Commission’s VAT Information Exchange System (VIES) provides an online tool that allows businesses and traders to verify the validity of a VAT number issued by any EU member state. The VIES tool can be accessed on the European Commission’s website and is available 24/7, making it a convenient and efficient way to verify the validity of a VAT number.

Step 1:

Input Your VAT Number and the VAT from the Company You Want to Check

Step 2:

Check the results

A green indicator shows that the number is active. In many countries, you will also get the company details which you should compare with your invoicing data. Currently, this feature only works for german companies. If the number is inactive, you will see it on the result page showing you that it is inactive or dont exist.

Step 3:

Print/ Save The Confirmation

Recording the VAT number verification for every transaction you make is important. This is especially important if you don’t charge VAT on your invoices. You can print out the result of the VAT number verification or save it as a PDF and attach it to the linked transactions/invoices. By this, you will prove that you have checked the validity of the VAT number, which can protect you from potential fines or claims from tax authorities paying the VAT for a non-VAT invoice.

Never forget, verifying the validity of a VAT number is crucial for businesses operating within the EU. By following these simple steps, you can easily check the validity of a VAT number on VIES-on-the-Web and ensure compliance with VAT regulations. Remember to record the result for every transaction to protect your business from potential issues with tax authorities.

frequently asked questions

about VAT

<150

Selled Companies

#1

Shelf-company Seller

3+

Experts

we are online

chat with us

Get your questions answered quickly. Let’s review your needs to find the most efficient way to achieve your goals.